Are HR workflows a pain point for your business?

Do you feel bogged down by all of the payroll, benefits, and HR administrative duties? If so, you’re not alone. HR is one of the most complex, nuanced, and critical components of your business — and finding the time to deal with all of those HR headaches isn’t easy. You have a business to run, people to manage, and decisions to make.

So, when it comes down to picking the right employee benefits package or navigating the rocky terrain of HR compliance, you’re at a loss. Even if you have an internal HR team, they don’t always have the tools, resources, or expertise to handle some of your more complex HR needs. Fortunately, there’s a solution:

Professional Employer Organizations have been helping companies build better HR practices for decades.

Here’s how they work.

Understanding PEOs

A Professional Employer Organization (or PEO) is a cost-effective HR outsourcing solution that leverages co-employment to provide a wealth of HR solutions to businesses. A core function of PEOs is providing benefits for employees (e.g., dental, life insurance, health insurance, etc.) as well as payroll, workers’ compensation, and other administrative HR work. PEOs can also assist with tax filings and keeping your company compliant with all state and government regulations — which often overburdens small businesses.

One of the reasons that PEOs are hyper-effective at managing key HR issues such as benefits is through the use of co-employment — a business tool that gives PEOs the wiggle room to impact every layer of HR.

Co-Employment Explained

When businesses first hear the term “co-employment,” it sounds a little daunting. After all, you built your business from the ground-up; why would you hand the reins over to someone else?

It’s important to realize that a PEO is only acting as an administrator of HR duties and responsibilities — not everyday business management. So, you will still be in control of managing your business and your employees. PEOs focus solely on employee-related responsibilities. And, co-employment has the added benefit of giving your legal employer responsibilities to your PEO partner — allowing the PEO to save you time and resources and allowing you to only deal with issues that are mission-critical for your company and your employees.

There are plenty of advantages to co-employment. Think of it as a business tool giving you the freedom and flexibility to assign critical tasks to a consulting body. You, as the business owner, still retain the rights to hire and fire employees, and you still run the day-to-day business processes.

Benefits of PEOs

A PEO can be a critical driver of business success. They can help you stay compliant and reduce risk — which can help you relax and focus on other business needs.

Let’s look at some of the core benefits of PEOs:

Employee Benefits

Your benefits are the lever that unlocks better hires. 43% of leading companies have improved their benefits over the past year. And, over 15% of employees actively looking for another job site benefits as a driving factor. For small businesses, finding competitive benefits can be draining. Buying benefits through a broker is expensive — and you only have the buying power of one small company.

With a PEO in your corner, you have the economies of scale to purchase hyper-affordable benefit packages that are typically reserved for larger corporations. Not only does a PEO help you achieve better prices on health insurance and other benefits, but they can help you offer a larger suite of benefits to your employees.

These benefits include:

There are hundreds of nuances involved in picking benefits. PEOs help you traverse these nuances with key benefit partnerships and a deep understanding of the current benefits landscape.

Summary: How Do PEOs Help With Employee Benefits?

PEOs use up-to-date industry insights and economies of scale to partner with key benefit carriers that meet the needs of your current (and future!) employees.

Compliance

Handling employee-related compliance issues requires industry insights. With increasingly complex laws and regulatory bodies (like OSHA), HR compliance can be scary for small businesses. Government, state, and local agencies can levy hefty fines on your business if you fail to meet specific compliance standards, and businesses can deal with the regulatory bodies of multiple states. In fact, your business is responsible for adhering to a specific set of standards in each state where your employees are located. So, if you have flexible hours and locations, you could be dealing with an incredibly intricate compliance umbrella.

PEOs can help you stay compliant by adjusting your workflows and consulting with you on any necessary changes.

- Did you know that payment rates vary by city, state, and even business size?

- Are you aware that California recently passed Assembly Bill No. 1008 — which forbids your company from asking about an applicant’s criminal history?

- Did you know that Delaware, Massachusetts, Oregon, NYC, and California no longer allow employers to ask applicants about previous wages?

There are thousands of unique laws that you must follow. And, failure to comply with any of them can result in fines.

A PEO will help you understand the regulatory requirements of your business, and help you train and educate employees to reduce HR risks. Whether this is creating an employee handbook or working one-on-one with you to develop best-of-breed practices, PEOs help you stay compliant.

Summary: How Do PEOs Help Reduce Risk?

PEOs leverage deep regulatory understanding to produce HR best-practices for your business that help keep you up-to-date on any changes in your HR requirements.

Workers’ Compensation

As many as 70% of businesses are currently overpaying for their workers’ compensation plans. For many small businesses, workers’ comp is a revenue sink. Since workers’ comp insurers often handle insurance plans on a case-by-case basis, small businesses can lose out on the economies of scale of larger PEOs who typically pay smaller premiums.

With a PEO, companies instantly get access to those economies of scale regardless of their size. Since PEOs work with many different businesses, they can leverage a massive pool of employees to secure incredible workers’ comp benefits. Outside of the plan itself, PEOs help businesses deal with workers’ compensation claims as well as manage risk.

Summary: How Do PEOs Help With Workers’ Compensation?

PEOs leverage economies of scale to secure lower premiums and better plans. They help mitigate risks and deal with any claims if they arise.

Payroll

Most businesses are aware that payroll is a time-sink. Between setting up record governance systems, distributing pay, handling W2s, and dealing with any wage garnishments or income deduction, handling the day-to-day affairs of payroll requires keen attention to detail (and a Type A personality). That’s why 25% of businesses don’t document payroll policies, and 19% don’t even periodically review their payroll processes. You’ve got other things on your plate. And, your internal HR department may feel overwhelmed, or they may be lacking the appropriate resources. Since a PEO will act as a co-employer, it will handle the day-to-day payroll responsibilities of your entire business. These include:- Employee compensation

- Payroll recordkeeping

- Payroll management

- Payroll compliance

- Digital payroll (e.g., pay stubs, W2 forms, etc.)

- PTO

- Income deductions and wage garnishment

- and more!

HR Administration

From drug tests to handbooks, PEOs help businesses with their everyday HR administrative needs. Since the HR umbrella encompasses so many avenues of your employees’ lives, HR administration is an intricate job with many different hats. PEOs can help:

- Create, design, and distribute employee handbooks

- Set up the administration of drug tests

- Create and utilize onboarding procedures

- Assist with leave-of-absence requests

- Deal with terminations

- Handle HR document management

- Distribute recruitment paperwork

- Amend necessary HR documents

- Create a point of contact for both business leaders and employees.

- and more!

Summary: How Do PEOs Help With HR Administration?

PEOs assist in every facet of HR administration, from creating and administring handbooks to tracking documents.

Performance Management

Did you know that companies who regularly gather employee feedback have nearly 15% lower turnover rates? Or how about this — 69% of employees say they would work harder if their successes and efforts were better recognized!

HR performance management helps employees work harder and exist in a more relaxed, rewarding environment. But, only 8% of companies believe that their performance management systems are highly effective. This is where PEOs can offer critical support. Maintaining adequate performance management workflows isn’t easy — and it’s definitely time-consuming.

Here are a few of the performance management responsibilities that PEOs can handle:

- Developing adequate compensation and support

- Designing and distributing rewards systems

- Providing employee feedback coaching for supervisors

- Creating an atmosphere that supports and enables regular employee feedback

- Administering company climate surveys

- and more!

Summary: How Do PEOs Help With Performance Management?

PEOs act as critical enablers for performance management. They help develop systems, breed company culture, and keep you up-to-date on company climate.

Reducing Liability

Due to the nature of co-employment, your business can reduce liability by partnering with a PEO. Things like reporting taxes and dealing with workers’ compensation claims will be handled directly by your PEO. And, PEOs have the experience and talent to stay in-the-loop on all regulatory and compliance issues within the HR space. So, you don’t have to worry about HR compliance, and you can get back to running your business.

Summary: How Do PEOs Help With Liability?

PEOs assist with claims and help you manage compliance.

Recruiting

57% of HR professionals struggle to assess soft skills. And, only 27% of companies are transparent about pay and benefits. Building a better recruitment process unlocks the value trapped inside your organization and helps you leverage that value to hire the best possible candidates. PEOs help by introducing you to best hiring practices and giving you crucial support with your entire recruiting process. This may be training managers on how to conduct interviews or even producing wage and salary surveys to provide you with a good idea on what to offer future hires.

Here are a few ways PEOs can help with recruiting.

- Handling salary negotiations

- Manager training on interview processes

- Wage and salary surveys

- Streamlined recruiting funnel

- Assisting new hires with the onboarding procedures

- Distributing handbooks and critical company culture materials

- Helping breed better training practices into your onboarding strategy

- and more!

Summary: How Do PEOs Help With Recruiting?

PEOs help you develop superior recruiting standards and practices and inform you of any market changes or specific needs.

Cost Savings

All of the benefits listed above lead to one thing — cost savings. And, these cost savings aren’t just granular. Businesses that use a PEO are 50% less likely to go out of business. Between better benefits packages, lower HR costs, and streamlined workflows, PEOs save you money.

PEO FAQs

No! PEO co-employment gives a PEO the ability to manage backroom HR functions like payroll and benefits while you maintain control of job functions, employees, hiring, firing, etc.

Typically not. PEOs will align with your HR staff to inform and promote better HR practices, but they are not an internal HR replacement. Some small businesses leverage PEOs as their sole HR staff. But, that’s few and far between. The healthiest PEO relationships are typically built between in-house HR staff and PEOs. Remember, PEOs can handle many of the day-to-day business processes, but you’ll still be in control of your in-house team — which includes hiring and firing rights.

One of a PEO’s primary jobs is assisting you with compliance and risk. But, you, as a business, are ultimately responsible for any compliance issues. PEOs are there to help you stay compliant — not shelter risk.

Finding the Right PEO

Finding a PEO is a complex process. First, you need to look for PEOs in your area that understand your business. Then, you have to find the right fit. Some PEOs will advertise incredible cost-savings, but that often means that they provide lackluster coverage. Most businesses will want to choose a PEO that’s capable of handling their unique needs and has the coverage options that make sense for their employees.

It’s important to remember that PEOs can offer different services as well. Some PEOs will offer digital tools for employees, while others may not. Each PEO is a unique entity that has a blend of services and offerings.

Without proper comparison tools, understanding the pros and cons of each PEO is certainly difficult. But, once you do arrive at a PEO that you like, you’ll need to ask some key questions to see if they’re the right PEO for your business.

Here’s a checklist.

The PEO Checklist

Let’s be honest. You don’t want to be the first patient a new doctor sees, and you’re probably going to do some vetting before you hire a babysitter. You should treat your PEO the same way.

Here is a quick checklist of questions you should be asking.

- Do they offer a suite of cost-cutting benefits?

- Can they tailor those benefits to your employee's needs?

- What kind of customer service do they offer?

- Do they understand your business niche?

- Do they have experience with clients in your industry vertical?

- What kind of accreditations do they have?

- What kind of employee training do they provide?

- Are their employees certified and trained?

- What are their compliance procedures?

- Do they offer a unique tech stack?

- What happens to data within that tech stack?

- How do they manage risk?

- Do they have a list of happy clients as references?

While that checklist and some searching may garner a few qualified candidates, you still have to think about which one offers the best Service Level Agreement, how they operate, and whether or not they are the best possible fit. This means going back through that process a few times and slowly eliminating potential PEOs.

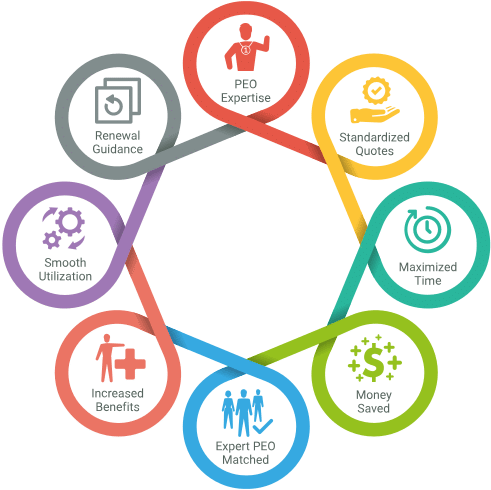

Free PEO Comparison Report

Are you looking for that perfect PEO but you’re overwhelmed by your options? Don’t worry! We can help! At PEO Consultants, we help businesses find PEO support through our multi-tiered PEO selection process. Check out this Free Comparison Report to see which PEOs may be best for your unique business needs.